” data-timestamp-html=”” data-check-event-based-preview data-is-vertical-video-embed=”false” data-network-id data-publish-date=”2023-04-11T14:02:42Z” data-video-section=”business” data-canonical-url=”https://www.cnn.com/videos/business/2023/04/11/small-banks-hard-to-borrow-money-kevin-oleary-cnntm-vpx.cnn” data-branding-key data-video-slug=”small-banks-hard-to-borrow-money-kevin-oleary-cnntm-vpx” data-first-publish-slug=”small-banks-hard-to-borrow-money-kevin-oleary-cnntm-vpx” data-video-tags data-details data-track-zone=”top” data-sticky-anchor-pos=”bottom”>

Here’s why ‘Shark Tank’ star says small banks won’t be around in 24 months

04:05 – Source: CNN

- Wall Street heavyweight JPMorgan Chase reported record sales, with Citigroup, Wells Fargo, BlackRock and PNC Financial also reporting strong first-quarter earnings. They’re the first bank earnings reports since Silicon Valley Bank and Signature Bank failed last month.

- The latest retail sales data came in weaker than expected, a potential sign that the economy is taking a turn for the worse. Investors will also get a look at consumer sentiment from the University of Michigan survey.

- First-quarter earnings for S&P 500 companies kick off this week, and economists are predicting the biggest earnings decline since the onset of the pandemic.

Our live coverage for the day has ended. Follow the latest business news here or read through the updates below.

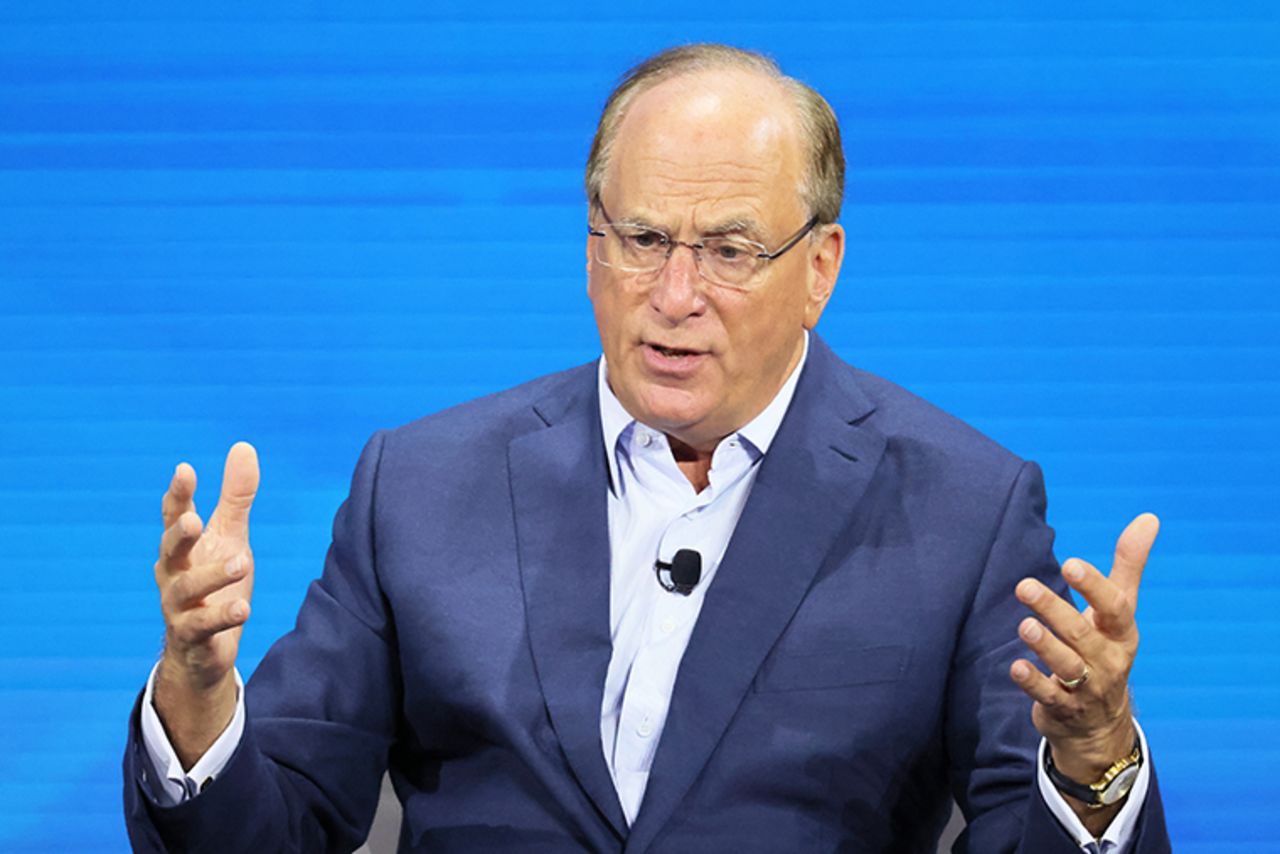

BlackRock, the world’s largest asset management firm, slashed Chief Executive Officer Larry Fink’s pay by 30% to $25.2 million for 2022, according to a filing with the Securities and Exchange Commission.

The move comes after the money manager reported first-quarter revenue that was down 10% from a year ago, as rising interest rates and economic uncertainty impacted the firm’s bottom line.

“With respect to 2022 compensation, management determined to reduce the impact of the firm’s decline in profitability on BlackRock’s broader employee population by concentrating the downward adjustments to total incentive awards toward senior management,” the filing said.

Total compensation for Fink, 70, included a base salary of $1.5 million and $23.7 million in total incentive awards. Several other executives saw their compensation reduced, including Rob Kapito, the firm’s president, whose package shrank by 34% to $18.95 million.

UBS’ purchase of Credit Suisse’s US subsidiaries can move forward, the Federal Reserve said Friday.

The statement comes a month after UBS stepped in to rescue the embattled Swiss lender and prevent turmoil in the financial sector from spreading, after an emergency loan of nearly $54 billion from the Swiss National Bank failed to stop the carnage.

The problems for Credit Suisse began when the Saudi National Bank, its largest backer, said it wouldn’t put up more cash after buying a nearly 10% stake in the bank for $1.5 billion in 2022.

Banking customers were already on edge after the collapses of Silicon Valley Bank and Signature Bank — so Credit Suisse shares tumbled more than 25% and saw billions of dollars of outflows.

The global turmoil has led US lawmakers to call for tighter regulations on banks. The Fed board said UBS will provide a quarterly updated plan for combining UBS’s and Credit Suisse’s US business and operations.

“The implementation plan will address UBS’s obligations to comply with more stringent enhanced prudential standards, including liquidity standards,” the Fed said in a statement.

UBS is shelling out 3 billion Swiss francs, or $3.25 billion, for Credit Suisse.

Stocks slid Friday after a slate of earnings beats from big banks fueled concerns that the Federal Reserve will raise interest rates at its next two meetings.

Still, the major indices gained for the week. The Dow rose 400 points, or 1.2%. The S&P 500 gained 0.8% and the Nasdaq Composite advanced 0.3%.

JPMorgan Chase on Friday reported first-quarter profit and revenue that crushed expectations, boosted by the Fed’s interest rate hiking campaign. Citigroup, Wells Fargo and PNC Financial also reported strong results.

CEO Jamie Dimon warned investors in the company’s post-earnings conference call that they should prepare for interest rates to be higher for longer than expected.

Wall Street seems to have taken note. Analysts increased their bets on a quarter-point rate hike at the Fed’s meeting in May and another in June.

Federal Reserve Governor Christopher Waller said Friday that the central bank needs to continue tightening monetary policy, further weighing down markets.

Austan Goolsbee, president of the Federal Reserve Bank of Chicago, said that it’s “definitely” possible the United States enters a mild recession after the tumult in banking last month.

Meanwhile, retail sales data declined more than expected, suggesting that Americans’ spending power and the US economy are weakening.

Consumer sentiment held fairly steady in April, even as concerns about a recession linger, according to the University of Michigan’s latest monthly survey.

“There was too much news to digest this morning, but the key takeaway is that the Fed has room to do more harm,” Edward Moya, senior market analyst at OANDA, said in a note.

The Dow slipped 144 points, or 0.4%.

The S&P 500 tumbled 0.2%.

The Nasdaq Composite sank 0.4%.

As stocks settle after the trading day, levels might still change slightly.

Austan Goolsbee, president of the Federal Reserve Bank of Chicago, said Friday he isn’t discounting the recent assessment from central bank economists that the banking crisis will tip the United States into a mild recession later this year.

“There’s no way you can look at current conditions around the world and in the US and not think that some mild recession is definitely on the table as a possibility,” Goolsbee said Friday during an interview on CNBC’s “Squawk Box.”

He added that, when viewed historically, the monetary tightening campaign undertaken by the Fed — hiking interest rates nine times in just over a year — is expected to slow GDP growth.

“When you get numbers like retail sales and others that are declining, if you look at construction, I think we’ve got to think about what’s the state of growth in the country,” he said. “Fortunately, the labor market continues to be very strong.”

Critics have lambasted the World Bank and, particularly, the International Monetary Fund, for predicting Russia’s economy would hold relatively stable this year despite international sanctions.

But sanctions are hurting Russia’s economy, even if World Bank forecasts don’t reflect it, according to the outgoing World Bank President David Malpass. Speaking to Julia Chatterley at the IMF-World Bank spring conference, David Malpass responded to criticism that you couldn’t trust GDP and economic data from Russia. He admitted “the quality of the data differs substantially by country…the reality is there’s not very much in terms of double checking of data”.

In January, the IMF projected that Russia’s economy would expand by 0.3% this year and 2.1% the next. That was much more optimistic than the latest forecasts from the World Bank, which still penciled in a contraction of just 3.3% this year. The Organization for Economic Cooperation and Development was the most pessimistic, forecasting a 5.6% contraction in Russia’s economy in 2023.

Malpass said that GDP numbers were not capturing the “reality” and “horror” of the war, and noted the Russian economy was suffering.

“I think life is hard in Russia…they’re excluded from travelling to many parts of the world, their supply chains have to change dramatically… young people moving out because they don’t want to be part of this war,” Malpass said.

Consumer sentiment tracked by the University of Michigan held steady in April, according to a preliminary reading released Friday.

So far, the university’s monthly surveys have shown a limited impact from the banking crisis on consumers’ attitudes, but Americans remain concerned about an upcoming recession and some lingering fears about inflation persist.

“Consumers are expecting a downturn, they’re not feeling as dismal as they were last summer, but they’re waiting for the other shoe to drop,” said Joanne Hsu, director of the surveys of consumers at the University of Michigan, in an interview with Bloomberg TV on Friday morning.

“We now have about a month of data following the collapse of SVB, and there hasn’t really been much of an effect on sentiment at all,” she said.

The latest survey also showed that higher gas prices helped push up year-ahead inflation expectations by a full percentage point, rising from 3.6% in March to 4.6% in April.

“Consumers are still feeling the pain of high prices,” Hsu told Bloomberg, noting that survey respondents were now mentioning gas prices for the first time since fall.

The latest cooldown in consumer and producer price hikes as well as the latest decline in retail sales are indications that the Federal Reserve’s efforts are working to bring down high inflation, Chicago Fed President Austan Goolsbee told CNBC on Friday.

“You don’t want to overreact to short-run news, but it feel likes like that’s moving in the right direction,” he said during an appearance on CNBC’s “Squawk Box.”

Goolsbee was quick to note that an area of critical importance to him in advance of the next Fed meeting is activity in banking and credit.

Earlier this week, Goolsbee noted that the Fed needs to be “on watch” for tighter credit conditions as a result of the banking turmoil last month. He referenced private sector analyst estimates that the spillover effects of the crisis equate to the Fed enacting rate hikes anywhere from a quarter point to three-quarters of a point.

“I’m an old-school data dog,” Goolsbee said Friday. “What I would do is spend the next three weeks getting out and figuring out how much credit tightening is coming.”

Chief executives at some of the largest banks in the United States were forced to address the elephant in the room as they reported first-quarter earnings on Friday morning: The regional banking crisis that brought Silicon Valley Bank and Signature Bank to ruin last month.

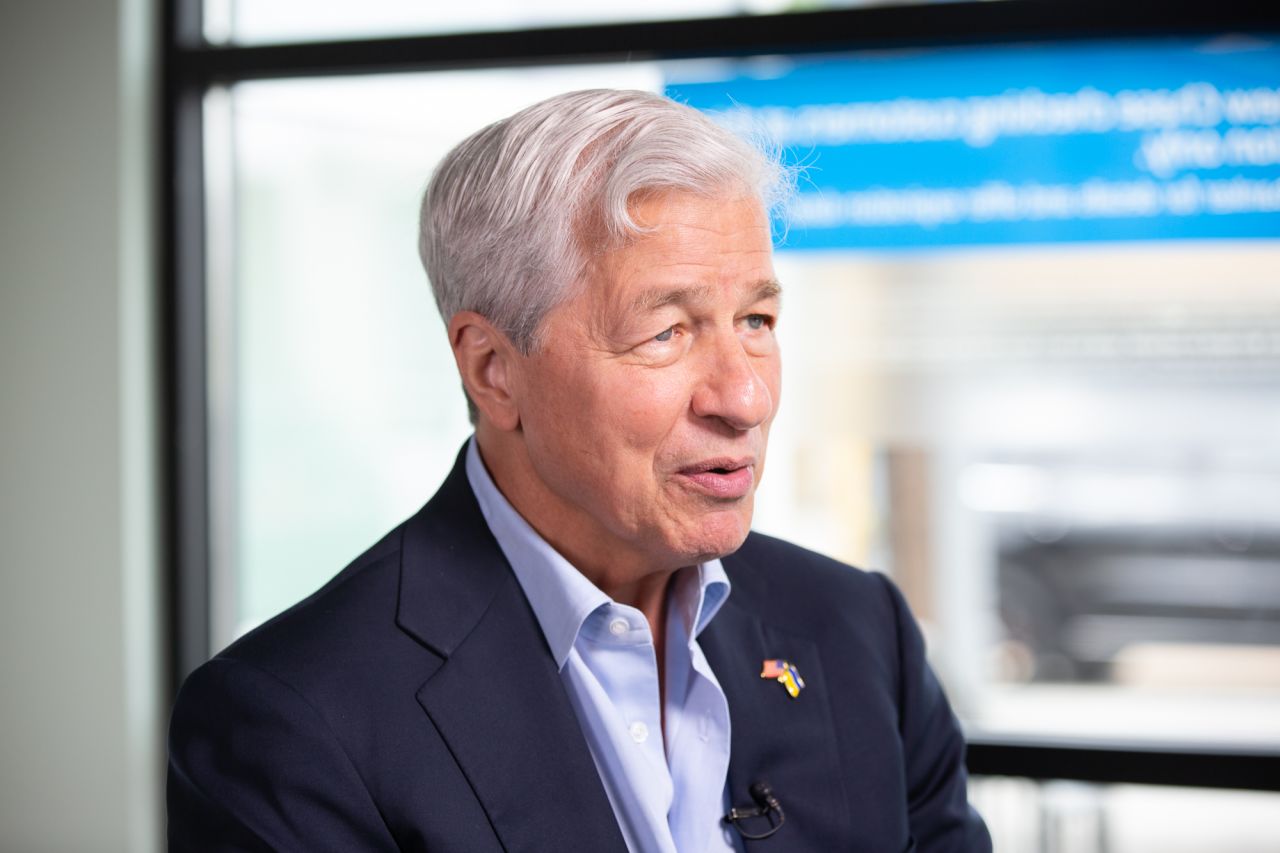

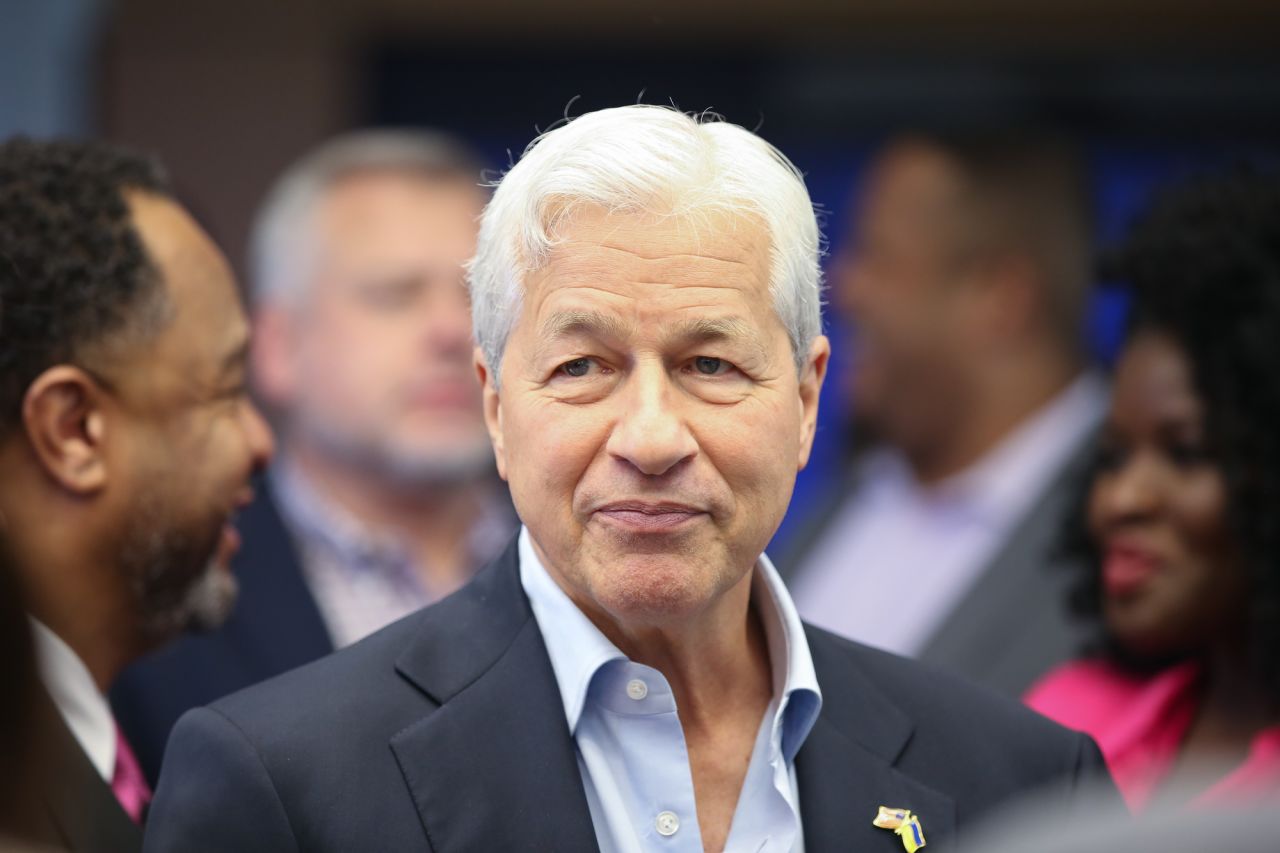

> Banking industry turmoil has added to risks of recessionary “storm clouds” on the horizon, said JPMorgan Chase CEO Jamie Dimon Friday in a release. He added that “the banking situation is distinct from 2008 as it has involved far fewer financial players and fewer issues that need to be resolved.”

Still, said Dimon, who leads the country’s largest bank, “financial conditions will likely tighten as lenders become more conservative, and we do not know if this will slow consumer spending.”

>“We are glad to have been in a strong position to help support the US financial system during the recent events that impacted the banking industry,” commented Wells Fargo CEO Charlie Scharf in a statement. “Regional and community banks are an important part of our financial system and are uniquely positioned to serve their customers and communities.”

> “I believe today’s crisis of confidence in the regional banking sector will further accelerate capital markets growth, and BlackRock will be a central player,” wrote BlackRock CEO Larry Fink on Friday.

“Increased financing through the capital markets will require the scale, multi-asset capabilities and excellence in portfolio construction that BlackRock consistently delivers across market cycles,” he said in a statement.

That means bad news for regional banks could be good news for BlackRock – the lack of trust in regional banks will drive more investment into capital markets and BlackRock is poised to benefit as that happens.

“Throughout our history, moments of market dislocation and disruption have served as inflection points for BlackRock,” he explained.

Regulators also hired BlackRock in early April to help the US government in the sale of the $114 billion in assets it collected from the collapse> Citigroup and PNC did not address the banking crisis in their releases, but will likely answer questions about how they’ve weathered the turmoil and what they see ahead at their first-quarter presentations, planned for 11 a.m. ET.

JPMorgan Chase CEO Jamie Dimon warned investors Friday not to be caught unawares if interest rates stay higher longer than expected.

“People need to be prepared. They shouldn’t pray that they don’t go up. They should prepare for them going up. And if it doesn’t happen, serendipity,” Dimon said on the company’s post-earnings conference call.

High interest rates have helped big banks, including JPMorgan Chase, since they widen the gap between the interest paid to customers and what they earn from investing that money. But climbing rates also helped drive last month’s collapse of Silicon Valley Bank, which held 55% of its customers deposits in long-dated bonds whose value diminished as interest rates rose.

Dimon stated that he believes the banking crisis will pass — even though he expects its effects to reverberate through the sector for years to come — but that the possibility of higher interest rates should remain on companies’ radars.

“If and when that happens, it will address problems in the economy. For those who are too exposed to floating rates, or those who are too exposed to [refinancing] risk, those exposures will be in multiple parts of the economy,” Dimon said.

“Now would be the time to fix it. Do not put yourself in a position where that risk is excessive for your company, your business, your investment pools,” he said.

Jamie Dimon, CEO of JPMorgan Chase, the largest US bank, told investors Friday that he isn’t too worried about a credit crunch resulting from the recent banking crisis.

“I wouldn’t use the word[s] ‘credit crunch,’” he said in response to a question about whether he was worried that lending would tighten in the bank after the collapse of Silicon Valley Bank and Signature Bank. There will be “a little bit of tightening,” said Dimon, but that will mostly be contained within the real estate market.

Dimon added that he’s more worried about recession than a credit crunch.

“I just look at it as a kind of a thumb on the scale. It just makes the financing conditions a little bit tighter and increases the odds of a recession,” he said. “That’s what that is. It’s not like a credit crunch.”

JPMorgan Chase said Friday its exposure to the office sector is limited, addressing concerns about the commercial real estate industry’s stability.

“Given the recent focus on commercial real estate, let me remind you that our office sector exposure is less than 10% of our portfolio and is focused in urban dense markets, and nearly two-thirds of our loans are multifamily, primarily in supply-constrained markets,” said Jeremy Barnum, chief financial officer, in the company’s post-earnings conference call.

Investors and regulators are watching the $20 trillion US commercial real estate market for signs that it could be the next shoe to drop after the banking tumult last month. That’s partly because the value of buildings is going down, particularly as offices in major cities remain vacant or half-empty as Americans opt to work from home.

The commercial real estate industry’s woes come after decades of unbridled growth powered by low interest rates and easy credit. That upward trend was interrupted by the Covid pandemic’s onset, and then when the Federal Reserve started hiking interest rates aggressively last year to stabilize the economy.

“There are obviously some big things here and there to pay attention to, but in the scheme of things for us, not a big issue,” Barnum said.

Spending at US retailers fell in March as consumers pulled back amid recessionary fears fueled by the banking crisis.

Retail sales, which are adjusted for seasonality but not for inflation, fell by 1% in March from the prior month, the Commerce Department reported on Friday. That was steeper than an expected 0.4% decline, according to Refinitiv, and above the revised 0.2% decline in the prior month.

The drop was driven by a pullback in spending at department stores and on durable goods such as appliances and furniture. Spending at general merchandise stores fell 3% in March from the prior month and spending at gas stations declined 5.5% during the same period. Excluding gas station sales, retail spending retreated 0.6% in March from February.

However, year-on-year retail spending rose 2.9%.

Citigroup shares were up about 0.8% in premarket trading after the bank posted strong first-quarter profits, beating analyst expectations for both earnings per share and revenue.

The bank brought in $21.4 billion in revenue versus expectations of $19.9 billion. Earnings per share were $2.19, estimates were for $1.67.

Citi CEO Jane Fraser and CFO Mark Mason will hold an earnings presentation at 11 a.m. ET.

Stocks slid Friday, even as big banks reported beats on their first-quarter earnings in an auspicious start to earnings season.

Investors were watching for clues about the financial sector’s stability, and whether the tumult in the sector last month could lead to tighter lending standards. A key point of interest was also how much big banks benefitted from increased deposit inflows when nervous customers fled from regional banks after the collapse of Silicon Valley Bank and Signature Bank.

JPMorgan, the largest bank in the United States and an economic bellwether, posted record revenue. Wells Fargo, Citigroup and PNC Financial Services also reported earnings beats.

Shares of JPMorgan Chase gained 4.8%, Wells Fargo rose 0.7%, Citigroup added 1.9% and PNC Financial Services ticked up 0.3%.

Meanwhile, retail sales came in weaker than expected as recession fears loom. Retail sales, which are adjusted for seasonality but not for inflation, fell by 1% in March from the month before, according to the Commerce Department. Economists expected a 0.4% decline, according to Refinitiv.

The Dow fell 38 points, or about 0.1%.

The S&P 500 sank 0.1%.

The Nasdaq Composite declined 0.5%.

The Federal Reserve could end its historic rate-hiking campaign after just one more quarter-point increase, said Federal Reserve Bank of Atlanta President Raphael Bostic in a Thursday interview with Reuters.

The Fed has approved nine rate hikes in a row since last March, the effects of which are only now starting to “bite,” Bostic said. Monetary policy can take months to trickle through the economy, but a slew of recent data suggests that inflation is finally cooling. The March Consumer Price Index shows price hikes have slowed for nine months in a row, and headline wholesale inflation reflected in the Producer Price Index has sunk to 2.7% after reaching double digit highs last year.

Bostic said the recent “chaos” in the banking sector, after the collapse of Silicon Valley Bank and Signature Bank, persuaded him to rethink the pace of rate hikes. However, he told Reuters he believes the turmoil will not have any lasting impact on the the US economy.

Analysts expect the Fed to raise rates by a quarter point at its upcoming policy meeting on May 2-3, according to the CME FedWatch Tool.

Regional bank PNC Financial reported first-quarter revenue of $5.6 billion and earnings per share of $3.98 vs. expectations of $3.66. Shares rose 5% on the news.

Wells Fargo reported first-quarter revenue of $20.7 billion against expectations of $20.1 billion. The San Francisco-based bank saw earnings of $4.9 billion, up from $3.8 billion a year earlier, an increase of about 32%. Shares of Wells Fargo rose 2.2%.

JPMorgan Chase on Friday reported first-quarter profit and revenue that roundly beat expectations, boosted by a year of rate hikes from the Federal Reserve.

The New York-based bank posted a profit of $12.6 billion or $4.10 per share. That’s up from $8.3 billion, or $2.63 per share from the same period a year before. Analysts expected earnings of $3.41 per share, according to Refinitiv.

With $3.67 trillion in assets, JPMorgan Chase is the largest bank in the United States and a bellwether for the US economy.

“The US economy continues to be on generally healthy footings — consumers are still spending and have strong balance sheets, and businesses are in good shape. However, the storm clouds that we have been monitoring for the past year remain on the horizon,” CEO Jamie Dimon said in a press release.

Net interest income rose to $20.8 billion, up 49% from the prior year, driven by the aggressive interest rate campaign the Fed kicked off last year to stabilize prices.

Deposits rose to $2.38 trillion during the first quarter from $2.34 trillion in the quarter ended in December. That comes after the banking tumult last month triggered a rush into big banks from nervous customers. Investors also looked to money market funds as a haven.

A key point of conversation after last month’s turmoil in the banking sector has been whether banks could tighten lending standards, leading customers to spend less as it becomes more difficult to borrow money for large purchases like homes and cars.

“Financial conditions will likely tighten as lenders become more conservative, and we do not know if this will slow consumer spending,” Dimon said, adding that JPMorgan Chase is “confident that we can serve the needs of our customers and clients in all environments.”

Shares of JPMorgan Chase climbed 6.1% in pre-market trading. The company’s post-earnings conference call is slated for 8:30 a.m. ET.

Stocks: US stock futures fell ahead of several bank earnings this morning. Investors also fretted a retail sales report that is expected to show consumers are pulling back on their spending. Dow futures were down 75 points, or 0.2%. S&P 500 futures fell 0.2%. Nasdaq futures were 0.4% lower. European stocks were higher and Asian stocks closed up.

Fear & Greed Index: 67 = Greed

Oil & gas: US oil prices were up 0.3% to $82 a barrel. Average US gas prices rose to $3.66 a gallon.

Wall Street is searching for answers to two key questions: Is the economy headed for a recession? And, if so, who’s poised to weather it?

Recession fears have ramped up in recent weeks after the banking tumult last month raised concerns about the financial sector’s health.

Earnings season for banks starts on Friday with JPMorgan Chase, Wells Fargo, BlackRock, Citigroup and PNC Financial Services slated to report before the bell. Investors will be watching for clues about stability.

Stocks have yet to price in the economy’s precarious position, with the S&P 500 adding about 7% this year. But markets have already seen volatile trading since then.

“We’re going to see a correction happen here, because it just never makes sense when the market’s going up and earnings are going down,” says Eric Sterner, chief investment officer at Apollon Wealth Management.

But while earnings are an undeniable factor driving markets, inflation remains a key concern. Wall Street remains overly optimistic that the Fed will cut rates later this year — even after officials indicated last month that they likely won’t — or that it could even orchestrate a soft landing. That hope, and the market’s resilience, could start to crumble in the next few weeks, said Megan Horneman, chief investment officer at Verdence Capital Advisors.

“You very well could see that catalyst over the next couple of weeks with earnings, and then this inflation data and then what the Fed says when they meet,” said Horneman.

Jeremy Grantham made his name predicting the dot-com crash in 2000 and the financial crisis in 2008. Now, the famous investor warns another epic bubble in financial markets is bursting — and the turmoil that swept through the banking sector last month is just the beginning.

“Other things will break, and who knows what they will be,” Grantham told CNN in an exclusive interview. “We’re by no means finished with the stress to the financial system.”

Since early 2022, when the S&P 500 hit an all-time high, US stocks have dropped about 15% as central banks have jacked up borrowing costs. But Grantham sees much steeper declines on the horizon.

The “best we can hope for,” he said, is a fall of about 27% from current levels, while the worst-case scenario would see a plunge of more than 50%. The low point might not arrive until “deep into next year,” he added.

Grantham sees uncomfortable parallels between markets today and 2000, when an explosion in the price of tech stocks was followed by a dizzying crash. There are also echoes of 2008, when a painful comedown in the US housing market almost broke the banking system.

What’s even more worrying is that this time, bubbles in the stock market and the real estate market are poised to burst simultaneously, Grantham said.

Comments are closed.