Import tariffs ‘inevitably’ making US inflation worse, China commentary says, as consumers and firms continue to foot the bill

Increased use of imports tariffs by the United States, including on Chinese goods, have only worsened its own inflation, while Washington’s anti-globalisation and decoupling stance is a threat to the world, according to a commentary by China’s top economic planner.

Trade relations between world’s two largest economies intensified last week after Washington unveiled major new tariffs on a range of Chinese products, including electric vehicles, advanced batteries, solar cells, steel, aluminium and medical equipment.

And on Sunday, China’s Ministry of Commerce said that it would investigate imports of polyformaldehyde copolymer – a plastic widely used in electronics and cars that is also known as polyoxymethylene copolymer – from the US, the European Union, Taiwan and Japan as part of an anti-dumping investigation.

“The US’ pursuit of anti-globalisation, decoupling and disconnection has resulted in a mismatch of global resources, as well as supply and demand, which will inevitably impose further constraints on the fall in [US] domestic inflation,” the National Development and Reform Commission (NDRC) said in a commentary posted on its WeChat social media account on Monday in its latest criticisms of Washington’s trade policies.

“This is not only a new problem facing the US economy, but also a threat facing the global economy,” according to the commentary written by Jin Xuan.

01:52

US proposes new round of tariffs on China in latest trade war escalation

US proposes new round of tariffs on China in latest trade war escalation

The official role of the author has not been disclosed by the top economic planner, although Jin Xuan is often viewed as a pen name used to deliver official messages.

Jin also wrote two separate commentaries in response to criticisms from the US and Europe on problems surrounding China’s industrial policy, including overcapacity and exports of electric vehicles, on April 30 and May 1.

Beijing has recently pushed back against overcapacity concerns from the US and European Union, who are worried that cheap imports damage their domestic manufacturing sectors.

The commentary appeared to the first in a series titled “maintaining economic globalisation and promoting inclusive development of the world economy”.

“Cheap and good quality” products made in China and other developing countries have helped to reduce inflation and costs of imports for the US economy for many years, they have also catered for the needs of the majority of American companies and consumers, Monday’s commentary said.

However, in recent years, the US government has raised tariffs on imports ranging from steel, machinery and equipment, chemicals, plastics as well as new energy vehicles and solar panels, the commentary added.

Even daily necessities such as food, clothing, and medicines have been subject to higher tariffs, the commentary said.

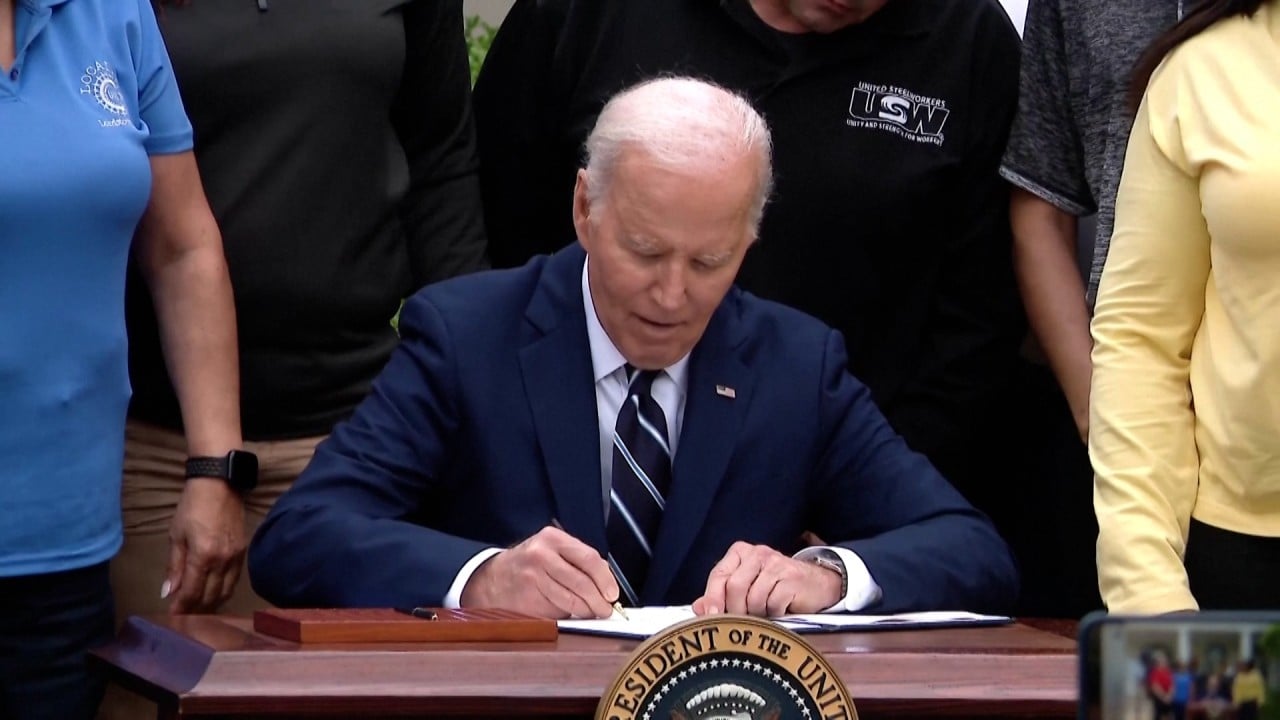

Before last week, the Biden administration had maintained the punitive Trump-era import tariffs on Chinese goods despite some calls for their removal as they increase production costs for US businesses.

The commentary appeared to be the first in a series titled “maintaining economic globalisation and promoting inclusive development of the world economy”.

“In April this year, US consumer price inflation rose by 0.3 per cent month on month and 3.4 per cent year on year, still higher than the 2 per cent target,” the NDRC commentary said.

“This is due to the impact of the pandemic, excessive fiscal and monetary policy stimulus, and the rise in prices of imported goods and services caused by the US’ promotion of anti-globalisation.”

These costs are ultimately paid by American businesses and consumers

The US Federal Reserve, in contrast, has raised interest rates to a 23-year high as it looks to bring inflation down to its long-term target of two per cent.

But despite making significant progress last year, the US central bank’s battle with inflation has faced a setback this year, with the rise of consumer prices accelerating again in the first quarter.

“Relevant US financial and economic officials have stated that tariffs have increased the direct costs borne by US consumers, raising the cost of importing goods to the US, and contributing to high inflation,” the NDRC commentary said.

“These costs are ultimately paid by American businesses and consumers.”