With China’s internet services industry largely sandboxed off from the rest of the world, having the most cutting-edge frontier models is less of an issue. Many AI start-ups are building on Meta Platforms’ open-source Llama models, anyway.

Instead, Chinese companies are left competing on the one thing that has ravaged so many tech markets before it: price.

E-commerce conglomerate Alibaba followed suit, as did internet search giant Baidu, social media and video gaming behemoth Tencent, and specialised AI firms iFlytek and SenseTime, both sanctioned by the US.

The most recent entrant in the price war is start-up Zhipu AI, one of China’s four “AI tigers”.

02:35

Taiwanese entertainer uses artificial intelligence to bring back deceased daughter

Taiwanese entertainer uses artificial intelligence to bring back deceased daughter

SenseTime co-founder and CEO Xu Li told the Post in May that companies were just trying to attract more clients and build their brands. And he expects his company to be profitable in two years.

Some companies such as Baidu have pointed to improving efficiencies in running the energy-intensive models as the reason behind the price reductions.

Nvidia has even been touting the massively improved power efficiency of its latest Blackwell GPUs. Stanford computer scientist Bill MacCartney explained to me in late May that these improvements were happening at every layer of the tech stack, from silicon to software.

This poses a challenge for Chinese AI firms without access to the bleeding edge of semiconductor production. Reuters reported that some Chinese AI companies are downgrading their chip designs just to get access to some of the manufacturing capacity of the world’s leading chip maker, Taiwan Semiconductor Manufacturing Company.

Alibaba co-founder and chairman Joe Tsai has said that he expects China to eventually “develop its own ability to make these high-end GPUs”, but he also said that the country’s AI champions are maybe two years behind those in the US.

China’s chip champions are scrambling to eke out whatever performance gains they can with equipment stockpiled before the US further escalated sanctions last year.

They’ll still be able to build very large systems by aggregating many of those chips together

A Huawei executive recently said its Ascend 910B could match the performance in some tasks as that of Nvidia’s A100, the predecessor of the chip maker’s leading H100 that is set to be replaced with the Blackwell chips.

In a market with limited access to Nvidia’s top hardware, Huawei has emerged as one potential solution to a complicated problem. The company’s chips are showing up in so-called AI boxes, all-in-one machines meant for small businesses. The price of a single machine can run anywhere from 300,000 yuan (US$41,400) to north of 2 million yuan.

Nvidia is trying to hang on to the bits of the Chinese market that do not need the most cutting-edge tech.

It may help that the yields for Huawei’s most advanced chips are likely relatively low. The Chinese tech firm is currently exploring ways to push a chip-making technique to its limits to produce 5-nanometre and 3-nm semiconductors, according to a patent made public in March.

“They’ll still be able to build very large systems by aggregating many of those chips together,” he told Wired in February.

11:56

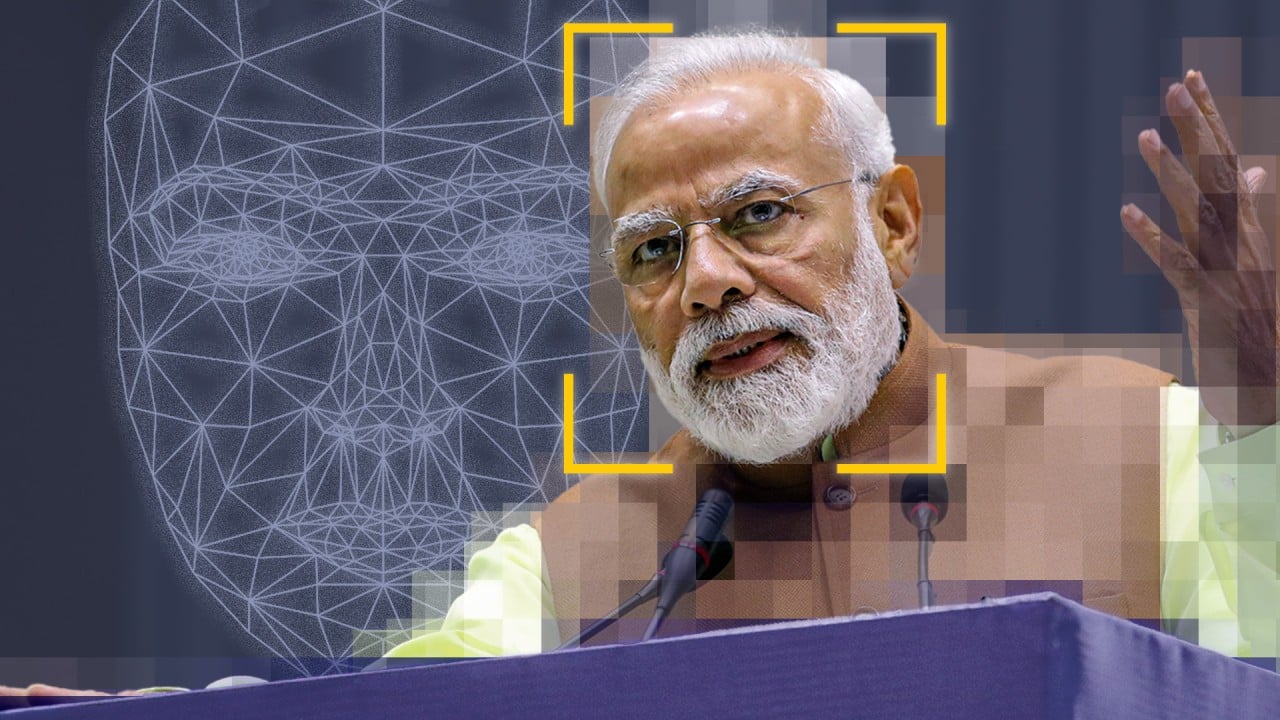

From India to China, how deepfakes are reshaping Asia politics

From India to China, how deepfakes are reshaping Asia politics

This, of course, means forgoing the power-efficiency gains from newer chips, and the lower costs associated with that.

If price reductions in China really are entirely the result of efficiency gains, then everyone in the market is winning – consumers, third-party service providers and the AI companies themselves.

But given the Chinese tech industry’s history of price wars, things could get cutthroat while tech firms burn through cash.

Scepticism is already starting to emerge as industry insiders and outsiders alike question the true value of these AI systems that are known for often generating false information and derivative work that requires a lot of editing.

Nobel Prize-winning economist Paul Romer, known for his work on the impact of technology in economic development, told me at the end of May that he doubts AI is going to change the world any more than cryptocurrencies did – which is to say, not much.

“I think there’s a very good chance that we’re going through a bubble right now, and that reflects excessive optimism about what AI is going to deliver,” he said.

Indeed, an overflow of optimism may be the order of the day – except when people are warning of Armageddon. And at least as far as consumers are concerned, AI price wars could bode well for them – and their wallets – in the near future, whether the aim is to get more work done or even produce imperial Chinese poetry.

60-Second Catch-up

Deep dives

New AI, old tricks: price war engulfs Chinese tech firms large and small

-

The price of AI services in China plummeted in May after ByteDance kicked off a price war by pricing access to its LLMs at 99.8 per cent below GPT-4

-

Industry insiders fear the harm could be fatal for many start-ups, but app developers are enjoying cheaper access to the tech powering their services

In the 18 months since Microsoft-backed OpenAI launched ChatGPT, Chinese tech firms large and small have rallied around a singular goal – besting the San Francisco-based start-up with their own Chinese-language chatbots.

The results have been mixed, with some tech giants claiming to have better results than GPT-4, OpenAI’s most advanced model, with Chinese queries. But with a deluge of more than 200 Chinese large language models (LLMs) – the tech powering these chatbots – from a slew of companies all jostling for market share, China’s AI firms can claim at least one other clear, albeit less boastworthy, advantage over their US counterparts: price.

Economist Paul Romer sees AI as hype, FDI real path to growth

-

AI is ‘going through a kind of a bubble right now’, the Nobel Prize-winning economist said, suggesting limits to the tech’s capabilities could soon set in

-

The US and China should compete in foreign direct investment, but projects like Belt and Road must focus on sustainable areas like real estate, he said

The artificial intelligence (AI) industry is “going through a kind of a bubble right now” and could soon hit a ceiling when it comes to productivity gains, according to Nobel laureate and former chief economist at the World Bank Paul Romer.

“The growth of digital technology hasn’t in the past ushered us into this new era of much more rapid productivity growth, and I doubt that it’s going to do it now,” Romer told the South China Morning Post on the sidelines of the UBS Asian Investment Conference in Hong Kong on Tuesday. “So I think the perception that somehow everything has changed is like the perception that cyber currencies are going to change the world.”

Hong Kong-listed SenseTime aims for profit in 2 years on generative AI frenzy

-

The company has set a goal of 100 per cent growth for its generative AI business this year, CEO and co-founder Xu Li told the Post in an interview

-

SenseTime has explored opportunities outside its traditional AI business, including smart city and smart business solutions

SenseTime, one of China’s artificial intelligence (AI) pioneers, is aiming for profitability within the next two years as revenue from its generative AI business tripled last year, and is expected to become the company’s new profit engine, according to CEO and co-founder Xu Li.

Hong Kong-listed SenseTime reported revenue of 1.184 billion yuan (US$163.4 million) from its generative AI-related business for 2023, marking a 199.9 per cent year-on-year increase, according to its latest annual financial report.

Elon Musk deepfake crypto scam highlights risks to Hong Kong

-

The Securities and Futures Commission has warned of a fraudulent crypto trading platform called Quantum AI, a long-time scam that uses deepfakes of Elon Musk

-

Hong Kong has proven particularly susceptible to AI-related scams, with fintech industry fraud growing 3.8 per cent in the first quarter

Last week, the Hong Kong Securities and Futures Commission (SFC) warned of a scam using deepfakes of Elon Musk touting a cryptocurrency trading platform called “Quantum AI”. The scam is old, but it highlights an alarming rise in the use of artificial intelligence (AI) to commit fraud – and Asia has proven particularly susceptible.

In its public warning on May 8, the SFC said that Quantum AI makes claims of being able to earn “too-good-to-be-true” returns and the regulator made a request to the Hong Kong Police Force to block access to related websites and social media pages. The linked domains were inaccessible as of this week, and the Facebook groups appear to have been removed.

Hong Kong’s film industry is turning to AI. Where do the humans come in?

-

With realistic virtual locations, there’s no need to fly actors, crew to different places for film shoots

-

Some veterans aren’t convinced AI can fix a stagnant film industry stuck with stale plots, same old faces

Roger Proeis is in Tseung Kwan O, in Hong Kong’s New Territories, and walking around a cavernous railway station unlike any in the city.

The station, complete with ticketing machines, escalators, seating areas and advertising billboards, is fake. The video producer created the whole set-up within his 5,000 sq ft studio using artificial intelligence (AI).

China’s 4 new ‘AI tigers’ emerge as investor favourites

-

Baichuan has joined a club of domestic unicorns focusing on generative artificial intelligence that include Zhipu AI, Moonshot AI and MiniMax

-

Known as the ‘four new AI tigers of China’, the start-ups have raised money from domestic tech giants, venture capitalists and state-backed investors

A group of artificial intelligence (AI) start-ups are emerging as China’s best hopes for reaching the frontier of ChatGPT-like technology, as they draw increasing attention from users and investors.

Among them, Baichuan is the latest to complete a new round of fundraising. While the start-up told the Post on Thursday that there had been some “discrepancies” in local reporting about the amount raised, several outlets estimated Baichuan’s latest valuation to be at about US$1.8 billion.

Alibaba reorients business, rejigs overhaul after catalogue of mistakes

-

Alibaba has made dramatic changes to its corporate restructuring plan as founders Jack Ma and Joe Tsai return to the driver’s seat

-

The e-commerce giant is betting on improved shopping experiences, artificial intelligence and a strengthened overseas push to regain momentum

When Alibaba Group Holding bought a controlling stake in supermarket chain Sun Art Retail in late 2020, it paid HK$28 billion (US$3.6 billion), or HK$8.1 per share, for the chance to take a larger bite of the bulging wallets of Chinese consumers.

But Alibaba’s “new retailing” vision of synergising online and offline shopping never took off. Three and a half years later, the acquired stake has lost 80 per cent of its value, based on Sun Art’s recent share price. The asset has also become a heavy burden with its falling revenues and a vast payroll of 100,000 employees.

China said to fall short of matching US advances in AI amid major challenges

-

Many Chinese-developed AI models have been built on Meta Platforms’ Llama system, according to a presentation made to Chinese Premier Li Qiang

-

The presentation at the Beijing Academy of Artificial Intelligence also pointed out issues related to computing infrastructure for training AI models

China is falling short of matching the United States in artificial intelligence (AI) advances because the nation’s efforts are “littered with many essential challenges in theory and technologies”, according to a recent slide presentation made to Chinese Premier Li Qiang.

Those difficulties were pointed out to Li during his recent inspection tour of the Beijing Academy of Artificial Intelligence (BAAI), a private non-profit organisation founded in 2018 that is engaged in AI research and development, according to a report broadcast by state-run China Central Television (CCTV).

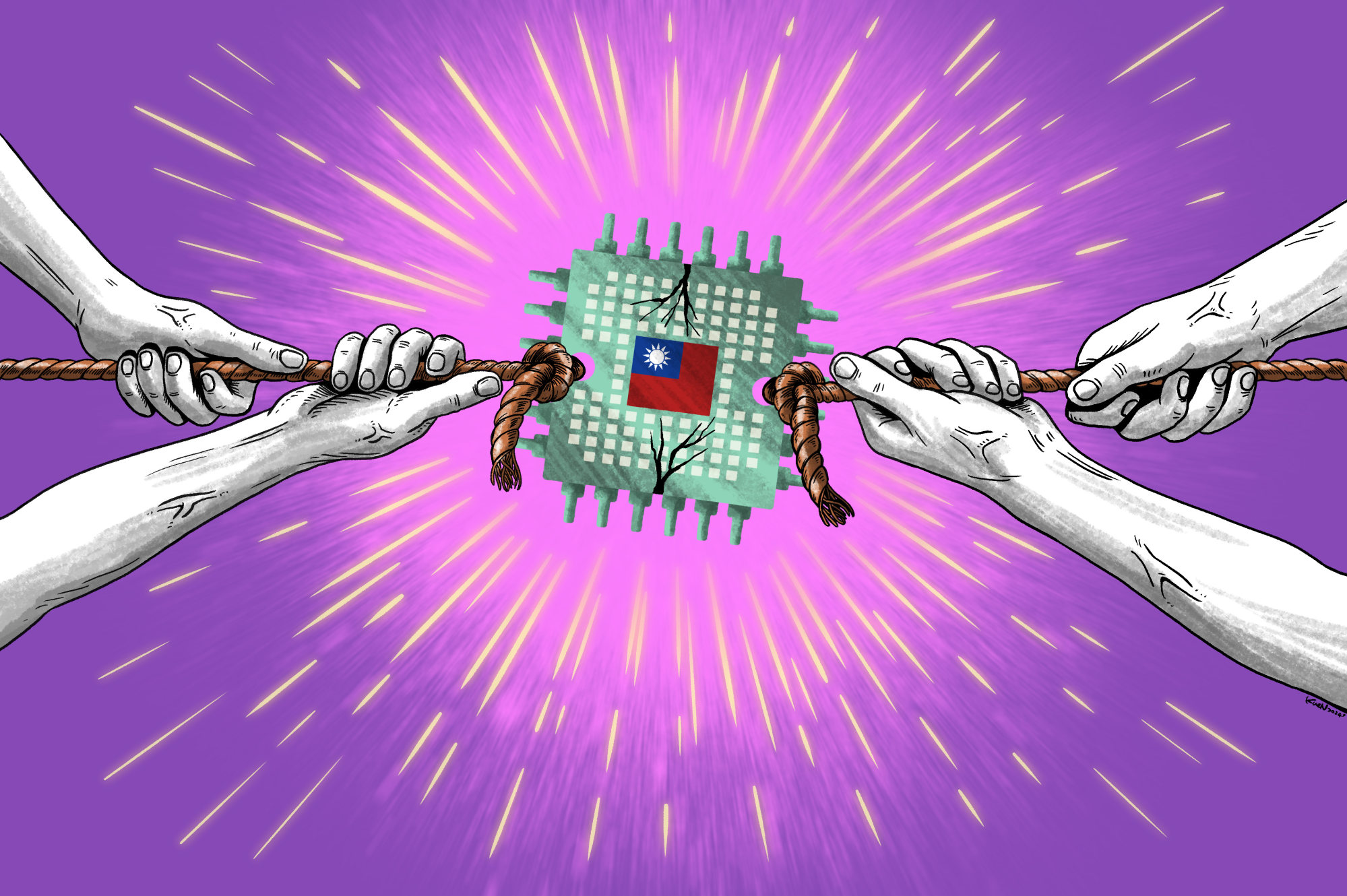

As tensions chip at Taiwan’s ‘silicon shield’, semiconductor superiority may shift

-

Cross-Strait tensions are said to be chipping away at Taiwan’s long-held dominance in the hi-tech industry where onshoring and reshoring efforts are becoming commonplace

-

Threat of conflict with mainland China and sanctions from the West have industry on edge, underpinning a rapid diversification of semiconductor supply chains

A sharp decline in Taiwan’s ties with mainland China could extend to the very devices being used to transmit and read this story.

The far-reaching implications from what has been a geopolitical tug of war are ultimately likely to bolster mainland China’s standing as a dominant supplier of older-model semiconductors while ramping up the need for Western allies to rely more on themselves for cutting-edge chips – a scenario that industry insiders say threatens to erode Taiwan’s formidable “silicon shield” that has long afforded the island a privileged position in the global supply chain.

Global Impact is a weekly curated newsletter featuring a news topic originating in China with a significant macro impact for our newsreaders around the world.